To view this press release as a word file, click here

To view this press release as a pdf file, click here

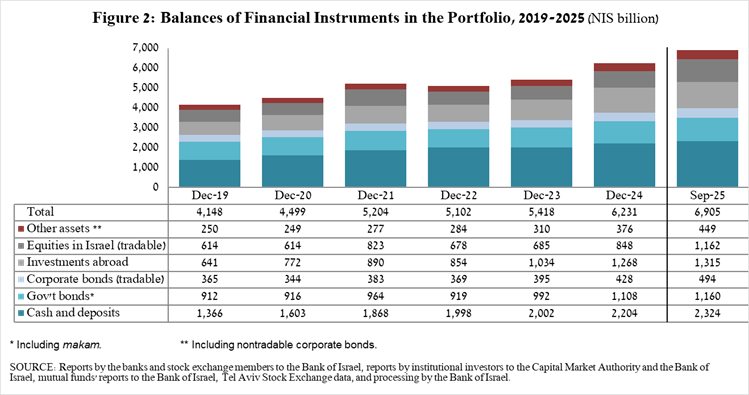

- In the third quarter of 2025, the balance of the public’s financial assets portfolio increased by approximately NIS 265.1 billion (4 percent), to about NIS 6.9 trillion.

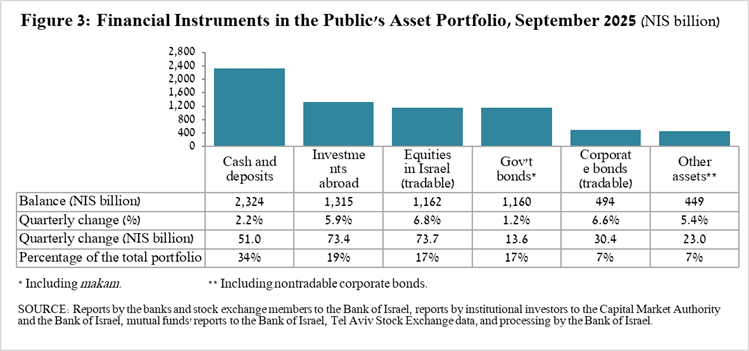

- The increase in the portfolio’s value in the third quarter was mainly due to increases in the balance of equities in Israel (6.8 percent), in the balance of corporate bonds (6.6 percent), and in the balance of investments abroad (5.9 percent).

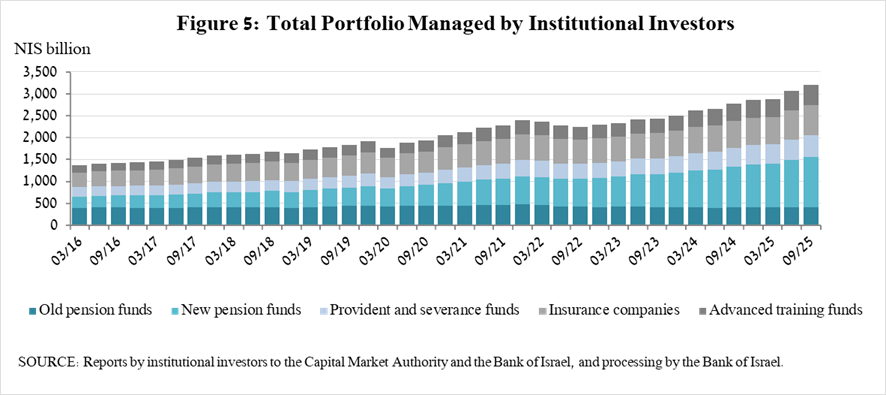

- The balance of the asset portfolio managed by institutional investors increased in the third quarter by approximately NIS 143 billion (4.7 percent), to approximately NIS 3.2 trillion at the end of the quarter.

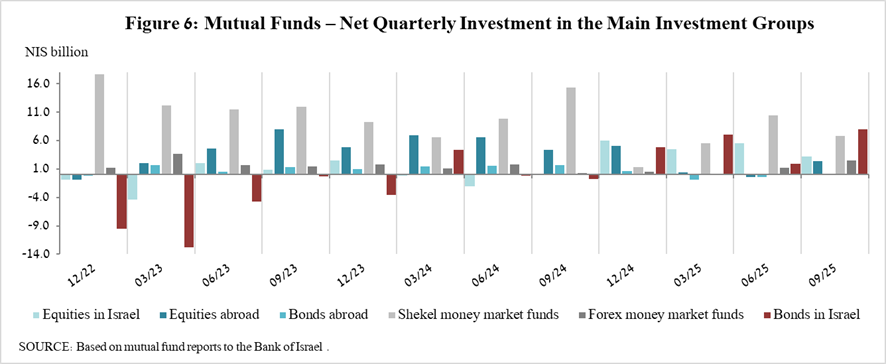

- The scope of the portfolio managed by mutual funds in Israel increased by approximately NIS 46.4 billion (6.9 percent) in the third quarter, to a level of NIS 722 billion. There were net new investments, mainly in funds specializing in domestic bonds, shekel money market funds, and in funds specializing in domestic equities.

1. The public’s total assets portfolio

In the third quarter of 2025, the balance of the public’s financial assets portfolio increased by approximately NIS 265.1 billion (about 4 percent), to about NIS 6.9 trillion (Figure 1). The share of the public’s financial assets portfolio relative to GDP increased by approximately 8.8 percentage points, to about 332.7 percent at the end of the quarter, as a result of an increase in the balance of the asset portfolio that was greater than that of GDP.

-

Analysis of the changes in the overall portfolio

Over the course of the third quarter, there were increases in the balances of the public’s holdings in all components of the portfolio. The increases in equities in Israel (6.8 percent), corporate bonds (6.6 percent), and investments abroad (5.9 percent) were notable.

- The balance of equities in Israel increased by about NIS 73.7 billion (6.8 percent), mainly in view of price increases.

- The balance of cash and deposits increased during the third quarter by about NIS 51 billion (2.2 percent) to about NIS 2.32 trillion, which is about 34 percent of the total portfolio.

- The balance of tradable corporate bonds in Israel increased during the quarter by about NIS 30.4 billion to about NIS 494 billion at the end of the quarter, due to a combination of net investments (estimated at NIS 24.5 billion) and price increases.

- The balance of tradable government bonds held by the public increased during the quarter by about NIS 17.6 billion to about NIS 490.3 billion at the end of the quarter (Figure 4). In a breakdown by holders of government bonds, institutional investors are the main holders, increasing the balance of their holdings during the quarter by about NIS 8 billion to a level of NIS 363 billion.

- The balance of MAKAM balance held by the public declined by about NIS 8.6 billion, to a level of about NIS 196 billion. During the quarter, the balance of holdings by financial and nonfinancial corporations and of households declined, while institutional investors increased the balance of their holdings.

The balance of investments abroad increased by approximately NIS 73 billion during the quarter, to about NIS 1.32 trillion at the end of the quarter, accounting for approximately 19 percent of the total asset portfolio. The development in the balance of investments abroad was mainly due to the following components:

- The balance of equities held abroad increased by approximately NIS 69.5 billion (9.8 percent), to about NIS 781 billion. This was against the background of price increases and net investments (estimated at about NIS 15 billion).

- The balance of tradable (corporate and government) bonds abroad increased by approximately NIS 6.2 billion (2.3 percent) during the quarter, to about NIS 276 billion. This increase was mainly due to price increases that were partly offset by net realizations.

As a result of the developments during the quarter, there was an increase in the share of foreign assets of about 0.3 percentage points (from 18.7 percent to 19 percent) and a decline of around 0.1 percentage points (from 25 percent to 24.9 percent) in foreign currency assets.

3. The portfolio managed by institutional investors[1]

- The balance of assets managed by all institutional investors increased in the third quarter by about NIS 143 billion (4.7 percent), to about NIS 3.2 trillion (approximately 46 percent of the public’s total financial assets portfolio). The increase in the balance of the managed portfolio during the quarter was reflected in the following components: equities in Israel—an increase of about NIS 26 billion (7.7 percent) in view of price increases; ETFs on foreign equities—an increase of about NIS 25 billion (10.2 percent), mainly in view of price increases on the equity indices abroad; equities abroad—an increase of about NIS 21 billion, in view of price increases on equity indices abroad; government bonds and MAKAM—an increase of about NIS 33.3 billion (NIS 3.6 billion); and corporate bond in Israel—an increase of about NIS 12.1 billion (6.3 percent) as a result of net investments and price increases.

4. The portfolio managed by mutual funds

The value of the portfolio managed by Israeli mutual funds increased in the third quarter by approximately NIS 46.4 billion (6.9 percent), to about NIS 722 billion at the end of the quarter, constituting about 10.5 percent of the public’s asset portfolio.

The increase in the third quarter was mostly due to net new investments totaling NIS 24 billion and price increases. Most of the new investment was in funds specializing in bonds in Israel (about NIS 8 billion), shekel money market funds (about NIS 6.8 billion), and funds specializing in equities in Israel (NIS 3.3 billion).

Further information and details:

Long-term tables on the asset portfolio are available here.

Long-term tables on institutional investors’ exposure to foreign exchange and to foreign assets are available here.

Long-term tables on mutual funds are available here.

[1] Excluding mutual funds.