To view this press relase a word file, click here

To view this press relase a pdf file, click here

- Exchange Rate Development

A strengthening of the shekel alongside a mixed trend of the dollar worldwide.

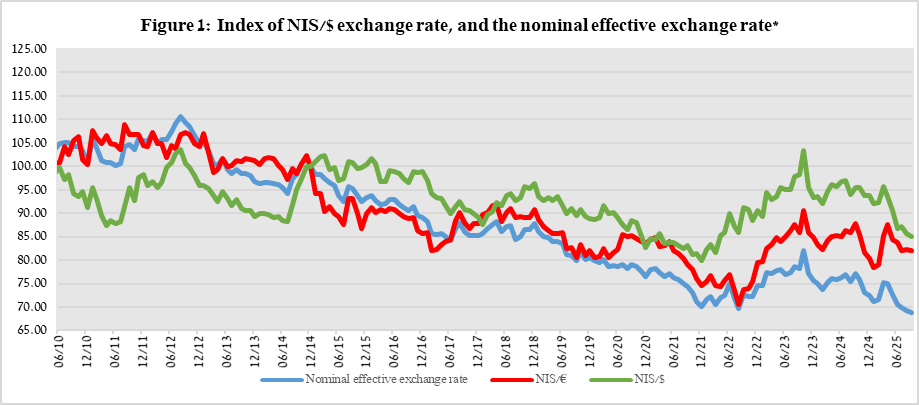

In the third quarter of 2025, the shekel strengthened by approximately 2.0 percent vis-à-vis the US dollar and by 1.9 percent vis-à-vis the euro, in view of the ceasefire in Gaza, which contributed to a decline in Israel’s risk premium. In addition, the shekel strengthened by 2.6 percent against the currencies of Israel's main trading partners, in terms of the nominal effective exchange rate (i.e., the trade-weighted average shekel exchange rate against those currencies).

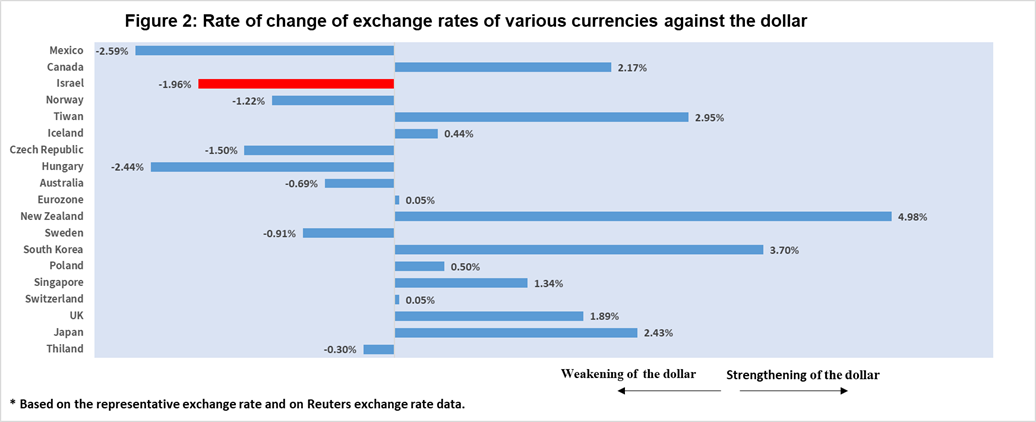

Worldwide, the trend of the US dollar was mixed against most of the world’s major currencies (Figure 2). Among other things, the dollar strengthened during the course of the third quarter by about 2.2 percent against the Canadian dollar, and by about 1.9 percent against the British pound, but weakened by about 3.7 percent against the South Korean Won and by about 5.0 percent against the New Zealand dollar.

- Exchange Rate Volatility

Decline in actual volatility alongside a decline in implied volatility

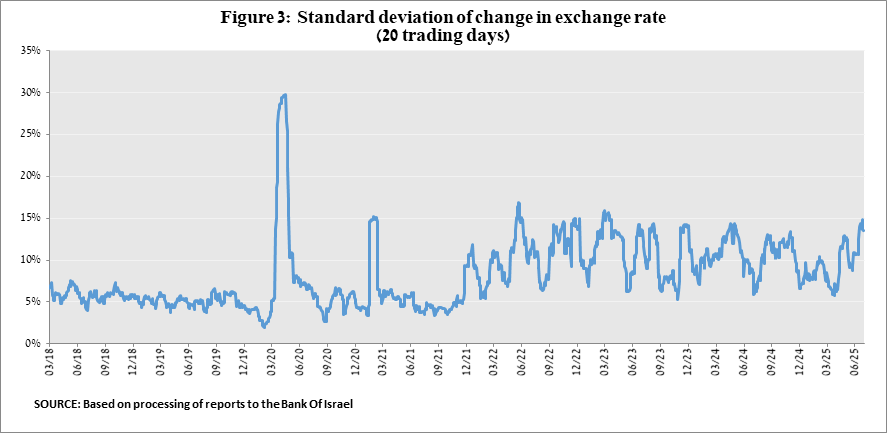

The average standard deviation of changes in the shekel/dollar exchange rate, which represents its actual volatility, declined by 1.7 percentage points during the quarter, to an average level of 9.4 percent.

The average implied volatility in over-the-counter shekel/dollar options which is an indication of expected exchange rate volatility, declined by 0.5 percentage points during the quarter, to an average level of about 9.3 percent at the end of the quarter.

This is alongside the average level of implied volatility in foreign exchange options in emerging markets, which declined by 1.5 percentage points compared to the previous quarter, to 9.6 percent at the end of the quarter. There was a similar decline in advanced economies, to 7.8 percent at the end of the quarter (Figure 4).

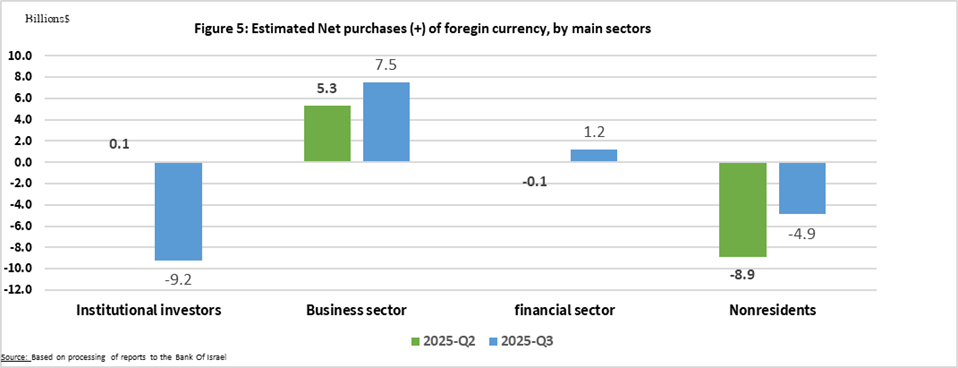

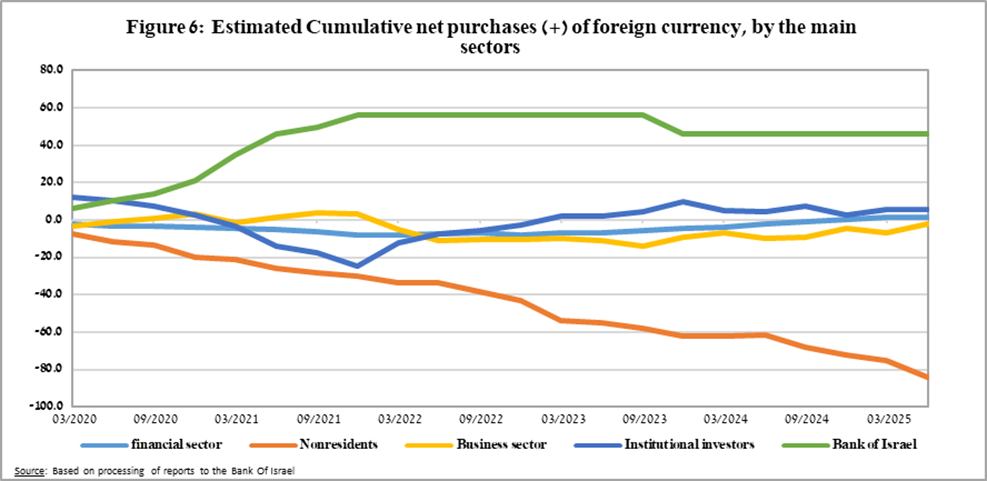

An estimate of activity by the main segments in the foreign exchange market indicates heterogeneous activity. In the third quarter, there were net foreign exchange sales by nonresidents and institutional investors, which supported the strengthening of the shekel, and foreign exchange purchases by the business sector. Institutional investors—pension funds, provident funds, and insurance companies—made a change in their activities. After moderate purchases in the previous quarter, totaling about $0.1 billion, they made net sales of foreign exchange totaling about $9.2 billion in the third quarter. Nonresidents continued to sell foreign exchange, but at a lower volume: about $4.9 billion in the third quarter, compared to about $8.9 billion in the second quarter. The business sector was prominent on the purchasing side, with a significant increase to about $7.5 billion, mainly due to an increase in net purchases by import firms and more moderate sales by export firms than in the previous quarter.

Finally, the financial sector (mainly the banks) moved from moderate sales in the second quarter to purchases totaling about $1.2 billion in the third quarter.

- Trading Volume in the Foreign Currency Market—Tables and Figures

Trading volume vis-à-vis the domestic banking system[3]

The average daily trading volume declined by about 13 percent during the quarter to $12.3 billion, with most of the decline coming from swap transactions.

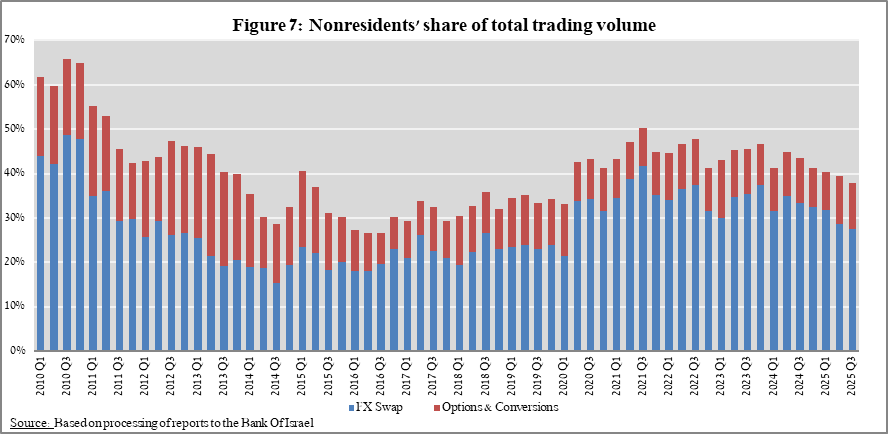

Nonresidents' share of total trading volume vis-à-vis the domestic banking system (spot and forward transactions, options, and swaps) declined by about 1.3 percentage points to about 38 percent at the end of the third quarter.

Estimated total trading volume[4]—domestic banking system and foreign reporting entities

The estimated total activity in transactions against the shekel, as reflected in reports from the domestic banking system and foreign reporting entities, indicates that nonresidents’ relative share of trading volume in spot and forward transactions (excluding swaps and options) was about 86 percent in the third quarter.

Trade between nonresidents constituted about 78 percent of the volume, which had a daily average of about $15.5 billion.

|

|

|

Relative share of total trading volume |

|

|

||

|

|

|

Trade between nonresidents |

Trade between a nonresident and a resident1 |

Trade between the domestic banking system and residents |

Total volume ($ million) |

Daily average ($ million) |

|

2025-Q3 |

Trading volume in spot and forward transactions |

77.6% |

8.5% |

13.9% |

947,504 |

15,040 |

|

Trading volume in swap and options transactions |

57.9% |

18.1% |

24.0% |

1,390,122 |

22,065 |

|

|

2025-Q2 |

Trading volume in spot and forward transactions |

77.0% |

9.0% |

13.9% |

1,015,629 |

16,650 |

|

Trading volume in swap and options transactions |

52.3% |

21.5% |

26.2% |

1,380,591 |

22,633 |

|

|

1 Trade between a nonresident and a resident includes: (a) reports by foreign reporting entities regarding transactions with residents; and (b) reports by domestic banks regarding transactions with nonresidents. |

||||||

[1] For additional information on the segments’ activity in the foreign exchange market, see “Statistical Bulletin 2024—Chapter D”.

[2] The main segments presented do not make up the entire market—for additional information, see the section on “The Database of Foreign Exchange Market Activity” in the Bank of Israel's “Statistical Bulletin” for 2024

[3] From the beginning of 2020, the data do not include branches of foreign banks in Israel.

[4] Total trading volume is an estimate of total activity in transactions against the shekel, based on reports by the domestic banking system and by foreign reporting entities.