To view this message as a file click here

- The research indicates that when maintaining a high level of construction supply over time, the affordability of housing, for the overall population, can be improved. When supply is high, it is possible to offer subsidized programs designated for specific populations while maintaining the proportion of purchases of the rest of the population—those that are eligible for a subsidy but did not win in lotteries, and those that are not eligible.

- Between the years 2012–15 and 2016–19, the share of households that purchased a first home increased. The probability of purchasing a home among households that did not buy a home within the framework of the Buyer’s Price program, whether because they did not win the lotteries or because they did not apply for them, remained stable relative to the years 2012–15. It may be concluded from this that the expansion of construction supply that occurred in the years 2016–19 was significant enough that despite the designation of a notable portion of the construction for the program exclusively, the probability of families that did not win the lotteries was maintained.

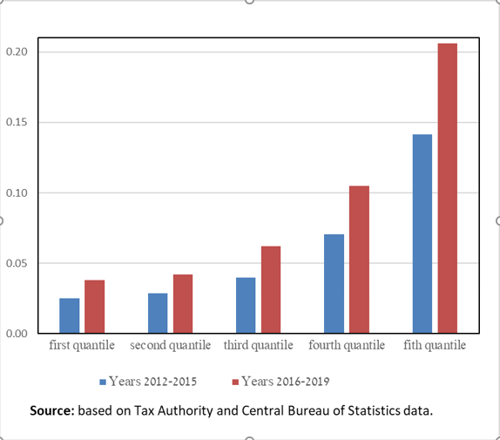

- The probability of buying a home increased between the years 2012–15 and 2016–19 in all income quintiles, but the probability in the upper quintiles increased more. Therefore, the gap in the probability of buying a home between the upper quintile and the other quintiles, particularly the bottom one, widened.

- The Buyer’s Price program, which was operated in 2016–19, enabled those who were eligible, to participate in lotteries, with the winners being granted a discount on the price of the home they bought. The percentage of married people and the percentage of families with children among the “Buyer’s Price” buyers was high compared to buyers in the open market, in accordance with the terms of eligibility.

- A comparison of the average household income among “Buyer’s Price” buyers with that of buyers in the open market, among married people, does not show a substantial difference.

Due to the continued increase in housing prices in 2008–15, the affordability of owner-occupied housing became one of the main goals of the government. As such, the government and its institutions took a series of steps to expand the supply of housing and to reduce the price for buyers. Alongside the marked increase in the scope of construction, a main step that the government took to reduce the price directly was operating the “Buyer’s Price” program at the end of 2015 with the goal of assisting households that do not own a home to purchase one. Within the framework of this program, the State marketed lands at a subsidized price to the entrepreneur offering the lowest final home price, and the eligibility, which was limited in quantity, to buy such a home was granted through a lottery among the eligible population.

Research conducted by Dr. Darin Vaisman of the Bank of Israel Research Department examined the effect of the government’s policy in the construction area and the subsidy of the homes for households that previously did not own a home. In the first part of the research, the socioeconomic characteristics —such as age, family status, and income—of first home buyers in 2016–19 compared to the years 2015–15 were examined, as well as the characteristics of the homes that were purchased. For the years 2016–19, a distinction was made between first home buyers within the framework of the “Buyers’ Price” program and buyers on the “open market”. The second part of the research examined the changes that occurred in the probability of households from various groups to purchase a first home in 2016–19 compared with 2012–15.

The analysis was made possible due to a unique database, which permits examining, for the first time, the characteristics of home buyers within the framework of the Buyer’s Price program, based on a representative sample of the population of employees in Israel.

In the research, it was found that buyers on the open market in 2016–19 were similar in their characteristics to buyers in 2012–2015 (Table 1). However, the characteristics of buyers within the framework of the “Buyer’s Price” program were somewhat different from those who purchased a home for the first time on the open market: the percentage of married couples and families with children among them was higher relative to the purchasers in the open market. When focusing just on married households (that is, with two potential earners), it was found that the average income of the buyers in the Buyer’s Price program was similar to that of purchasers on the open market.

Table 1

Characteristics of first home buyers and the potential buyers[1], among married-couple[2] exclusively

|

|

Share of families with children (percent) |

Average net annual household income[3] (NIS thousand) |

Average age |

|||||||

|

|

Bought on the open market |

Bought within the framework of the “Buyer’s Price” program |

The potential of first buyers |

Bought on the open market |

Bought within the framework of the “Buyer’s Price” program |

The potential of first buyers |

Bought on the open market |

Bought within the framework of the “Buyer’s Price” program |

The potential of first buyers |

|

|

2012-2015 |

65 |

|

77 |

163.5 |

|

106.0 |

30.4 |

|

33.4 |

|

|

2016-2019 |

68 |

77 |

77 |

177.8 |

189.0 |

118.6 |

30.4 |

31.2 |

33.2 |

|

The results of the analysis indicate that in 21016–19 the probability of young families, particularly those with children, to buy a first home increased, among other reasons due to these families’ eligibility to buy a home within the framework of the “Buyer’s Price” program. In addition, it was found that the probability to purchase a first home increased among all income quintiles (Figure 1). However, the probability of the higher quintiles increased more, so that the gap in the probability of purchasing a home between the upper quintile and the other quintiles, and in particular the lowest one, widened. When focusing solely on households that did not purchase a home within the framework of the Buyers Price program in 2016–19, whether because they did not win the lottery or because they did not enter it, it was found that the probability to purchase a home remained stable relative to the years 2012–15. Moreover, the probability of these households to purchase a home on the open market in the periphery increased even for the lower income quintiles. It may be concluded from this that the expansion of supply that occurred in 2016–19 was substantial compared to the years 2012–15, and therefore the probability of one who did not win in the “Buyers Price” lotteries to purchase a home was not adversely impacted. Thus, it may be concluded that maintaining a high level of construction supply, as was the case, for example, in the years 2021–22, is important for there to be housing affordability for the overall population: those who are eligible for the subsidy and those who are not, or did not win in the lotteries.

Figure 1

The estimated probability of those not owning a home1 to purchase a home in 2016–19 and in 2012–15, by income quintiles2

[1] Potential of purchasers includes all those that until that year had never owned a home; the research population includes employees up to age 40.

[2] Married couples are couples living together and managing a shared household.

[3] The data on income refers to net income of households from work as an employee, in 2018 prices.

Click to download as PDF Click to download as PDF