![]() To view this press release as a Word document

To view this press release as a Word document

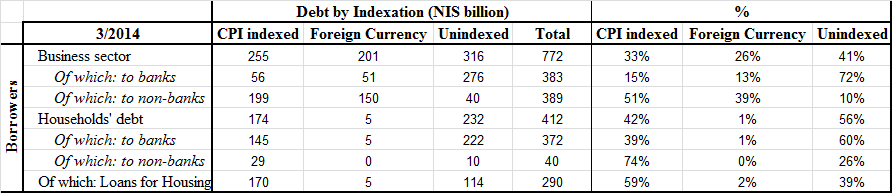

Business sector debt declined by 0.7 percent to around NIS 772 billion in March. Household debt increased by about NIS 2.9 billion (0.7 percent) to around NIS 412 billion at the end of the month.

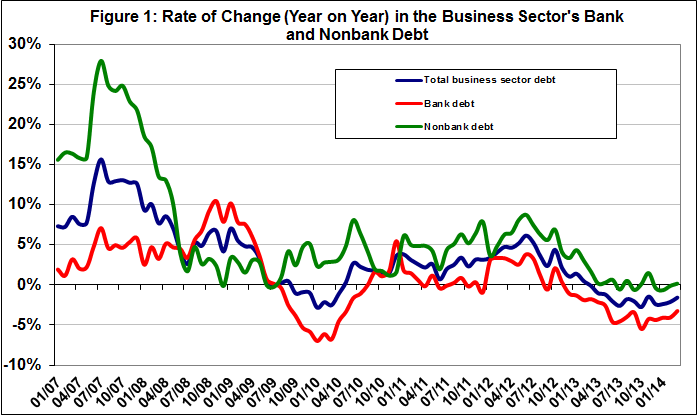

The business sector’s outstanding debt

- The total outstanding debt of the business sector declined by NIS 5 billion (0.7 percent) to around NIS 772 billion in March. The decline derived from net repayment of debt, the result of about NIS 4 billion in tradable bonds repaid, which were partly offset by funds raised through loans from banks and institutional investors. For the year to date, there has not been a marked change in the business sector’s bank debt.

- In April, the business sector (excluding banks and insurance companies) issued about NIS 2.6 billion in bonds, most of which were tradable bonds. This figure is similar to the average over the past two years, after the low issuance figure in the previous month.

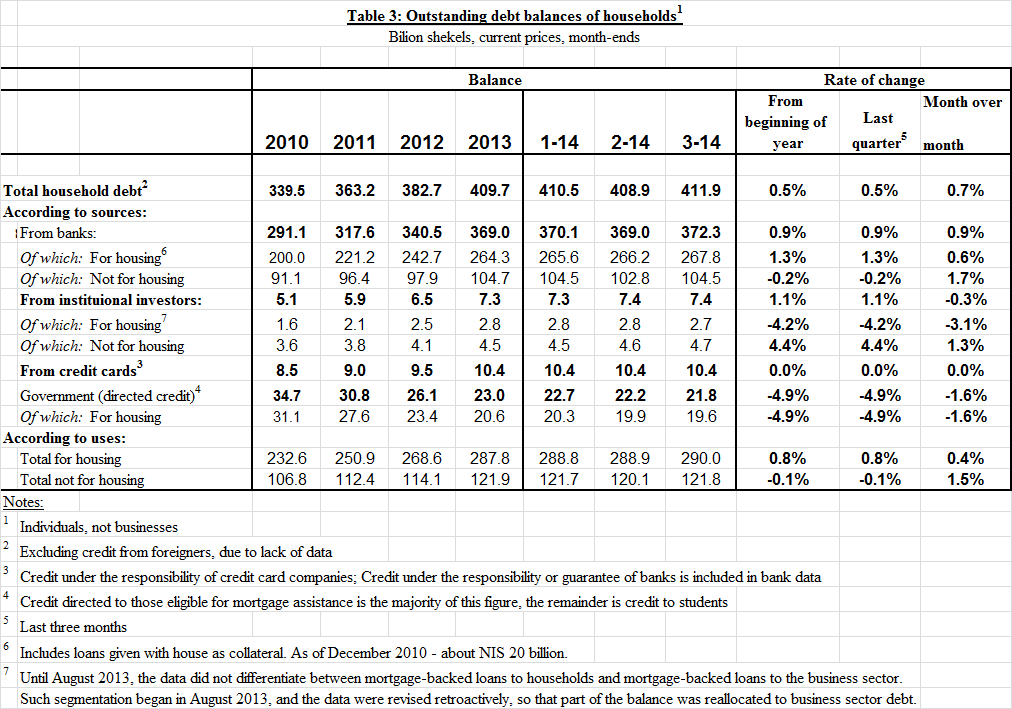

Household debt

- Households’ outstanding debt increased by about NIS 2.9 billion (0.7 percent) to about NIS 412 billion in March. The increase derived from growth of about NIS 2.4 billion in bank debt, primarily non-housing debt, as well as the impact of the increase in the CPI. The balance of housing debt, which is included in total household debt, increased by around NIS 1.2 billion, to around NIS 290 billion at the end of March.

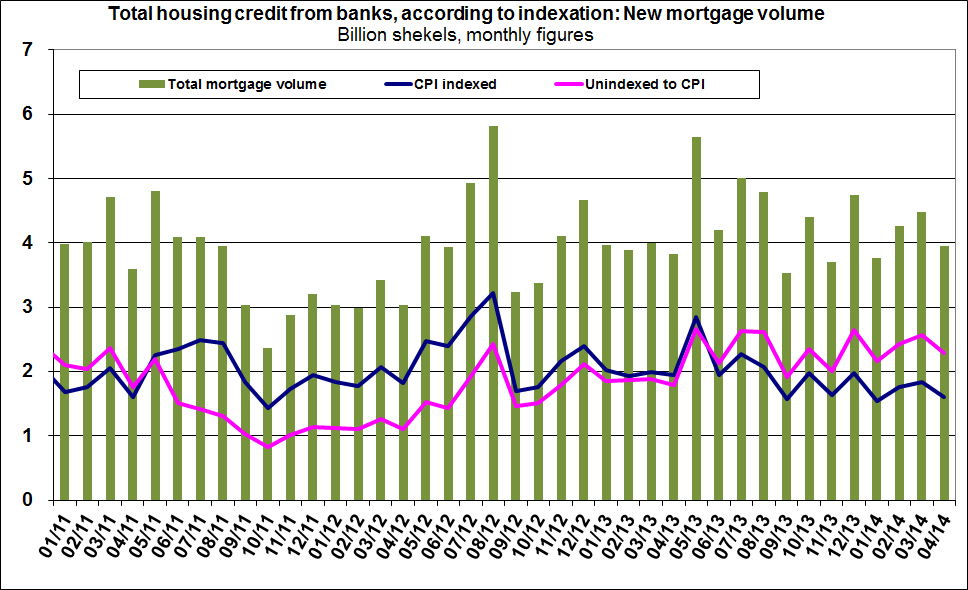

- In April, there were about NIS 4 billion in new mortgages taken out, slightly lower than the figure for March.

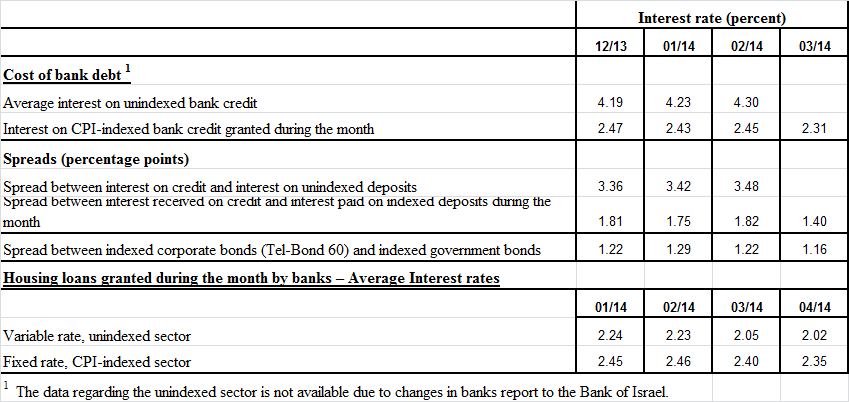

The cost of the debt

- In the CPI-indexed track, the spread between the interest rate on new bank credit granted and the interest rate on deposits narrowed in March by about 0.4 percentage points, due primarily to an increase in the interest rate on deposits and a decline in interest on credit.

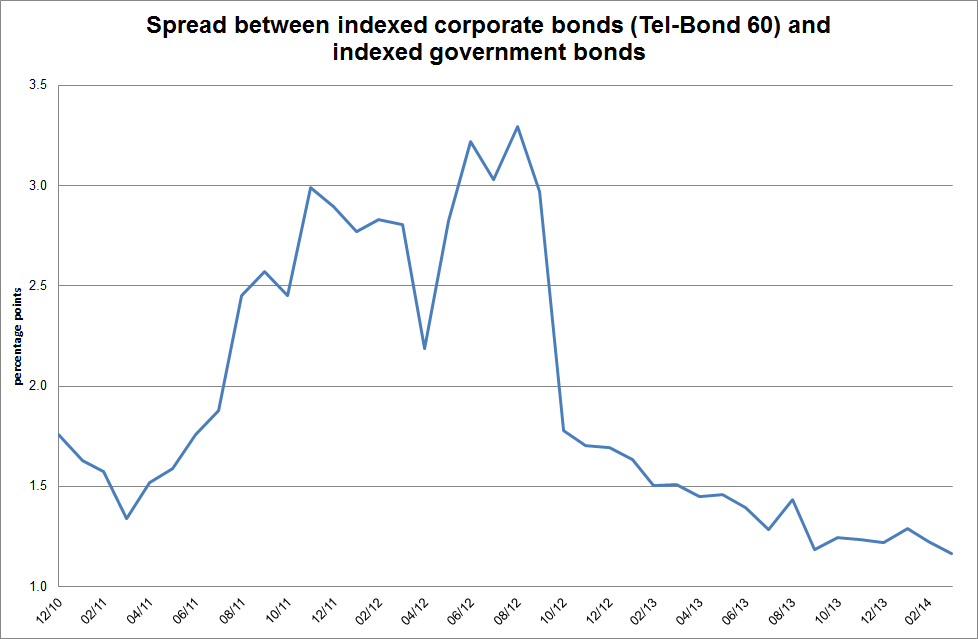

- At the end of March, the spread between the yield on CPI-indexed corporate bonds—measured by the Tel Bond 60—and average yields on CPI-indexed government bonds was 1.16 percentage points, lower by around 0.06 percentage points than the spread at the end of February.

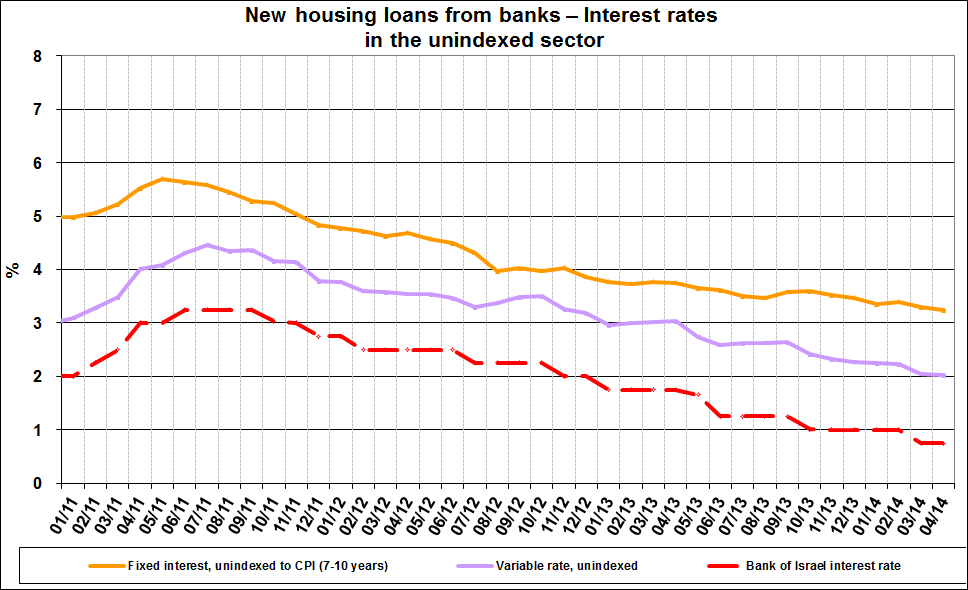

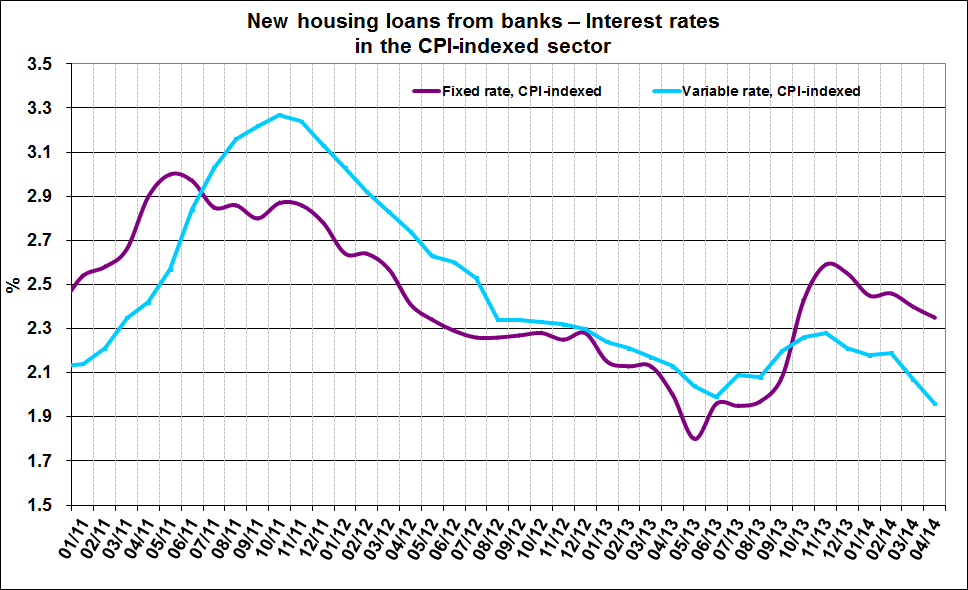

- In April, the average interest rate on new unindexed mortgages declined by around 0.03 percentage points. The interest rate on new CPI-indexed mortgages declined by around 0.05 percentage points.

For links to Data and Statistics on the Bank of Israel website: