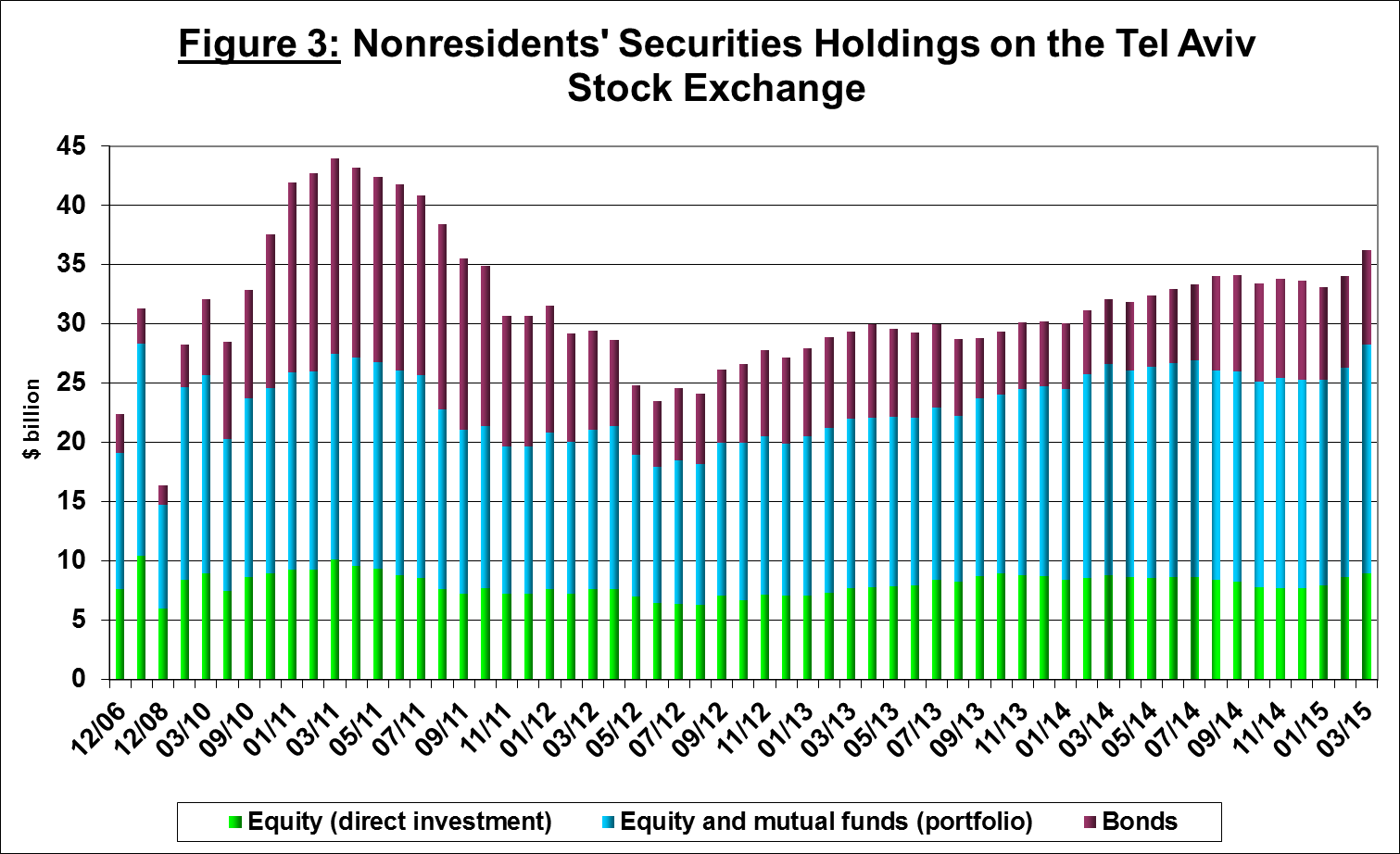

v In the first quarter of 2015, Israel’s surplus of assets over liabilities vis-à-vis abroad declined by about $0.3 billion (about 0.5 percent), in contrast to the significant increase of about $5.2 billion (8.6 percent) in the fourth quarter of 2014.

v An increase of $7.9 billion (about 3 percent) in the value of Israelis’ liabilities to abroad was almost completely offset by an increase of $7.6 billion (about 2.3 percent) in the value of Israelis’ assets abroad.

v The increase in the gross balance of liabilities to abroad derived mainly from an increase in the prices of shares held by nonresidents ($6.5 billion, about 2.4 percent), but also by the net investment flow in Israel ($4.1 billion, 1.5 percent).

v The increase in the value of the asset portfolio derived mainly from the flow of financial investments in foreign bonds traded abroad ($4 billion, 1.2 percent) alongside an average flow of investment of about $1.5 billion in the other channels.

v The gross external debt to GDP ratio declined by 0.6 percentage points in the first quarter of 2015, to about 34 percent at the end of March. The decline derived mainly from a decline in the balance of external debt, which was partially offset by the effect of the shekel’s depreciation on the shekel value of the debt.

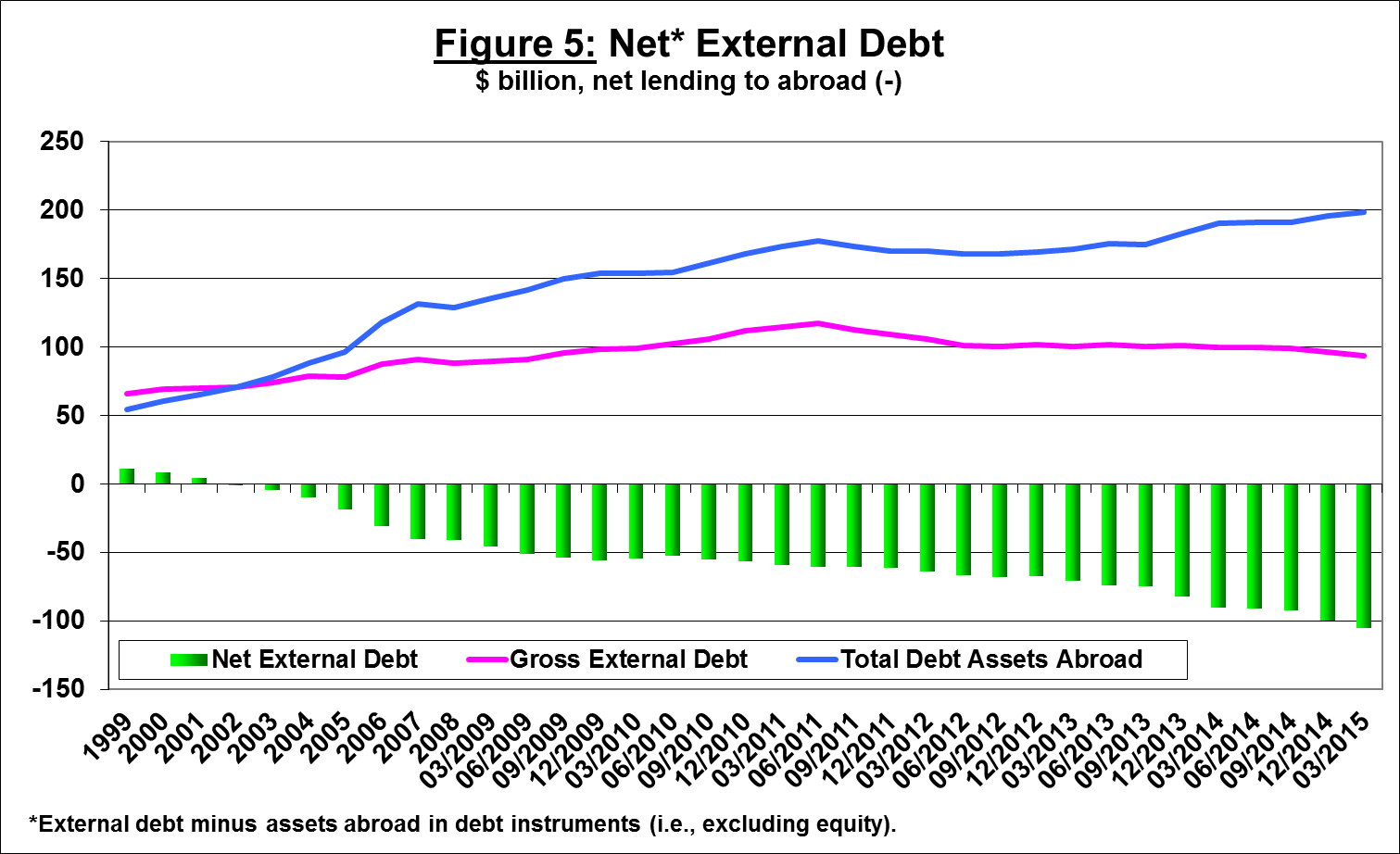

v The surplus of assets over liabilities vis-à-vis abroad in debt instruments alone (negative net external debt) increased in the first quarter of 2015 by about $5.3 billion (5 percent), to about $105 billion at the end of March.

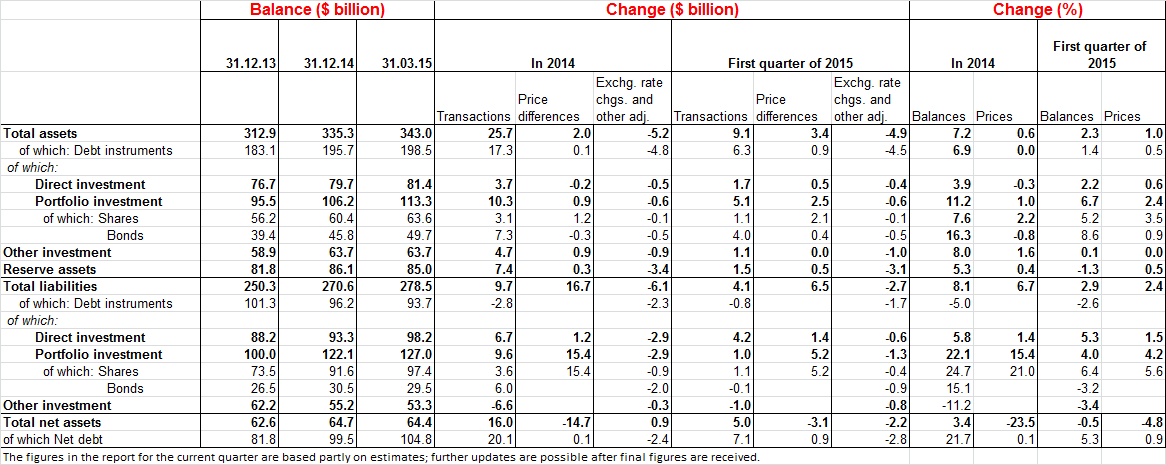

Israel's net assets abroad (the surplus of assets over liabilities) declined by $0.3 billion (about 0.5 percent) during the first quarter of 2015, to around $64.4 billion at the end of March. An increase of $7.9 billion (about 3 percent) in the value of Israelis’ liabilities to nonresidents was almost completely offset by an increase of about $7.6 billion (2.3 percent) in the value of Israelis’ assets abroad (Figure 1).

The value of Israel's assets abroad increased in the first quarter of 2015 by about $7.6 billion (2.3 percent), to about $343 billion at the end of March, mainly reflecting growth in the flow of financial investments by Israeli residents in tradable assets (mainly bonds) ($5.1 billion) and the flow of direct investments abroad.

The value of the shares portfolio increased by $3.1 billion (5.2 percent) during the first quarter of 2015: stock price increases on markets abroad totaled about $2.1 billion, and there was net flow of investments by Israelis totaling about $1.1 billion.

The balance of investments in tradable bonds abroad increased by about $3.9 billion (8.6 percent) in the first quarter of 2015: Net flow of investments in foreign bonds—about $4 billion—was partly offset by the effect of the depreciation of the shekel.

Other investments abroad remained unchanged during the first quarter of 2015: Net flow of investments totaling $1.1 billion—mainly growth in deposits by Israeli banks in foreign banks—were completely offset by the effect of the depreciation of the shekel during the period.

Foreign exchange reserves, in dollar terms, declined in the first quarter of 2015 by about $1.1 billion (1.3 percent). The decline in the dollar value is explained by the strengthening of the dollar vis-?-vis the other major currencies, and was partially offset by foreign exchange purchases by the Bank of Israel totaling $1.5 billion.

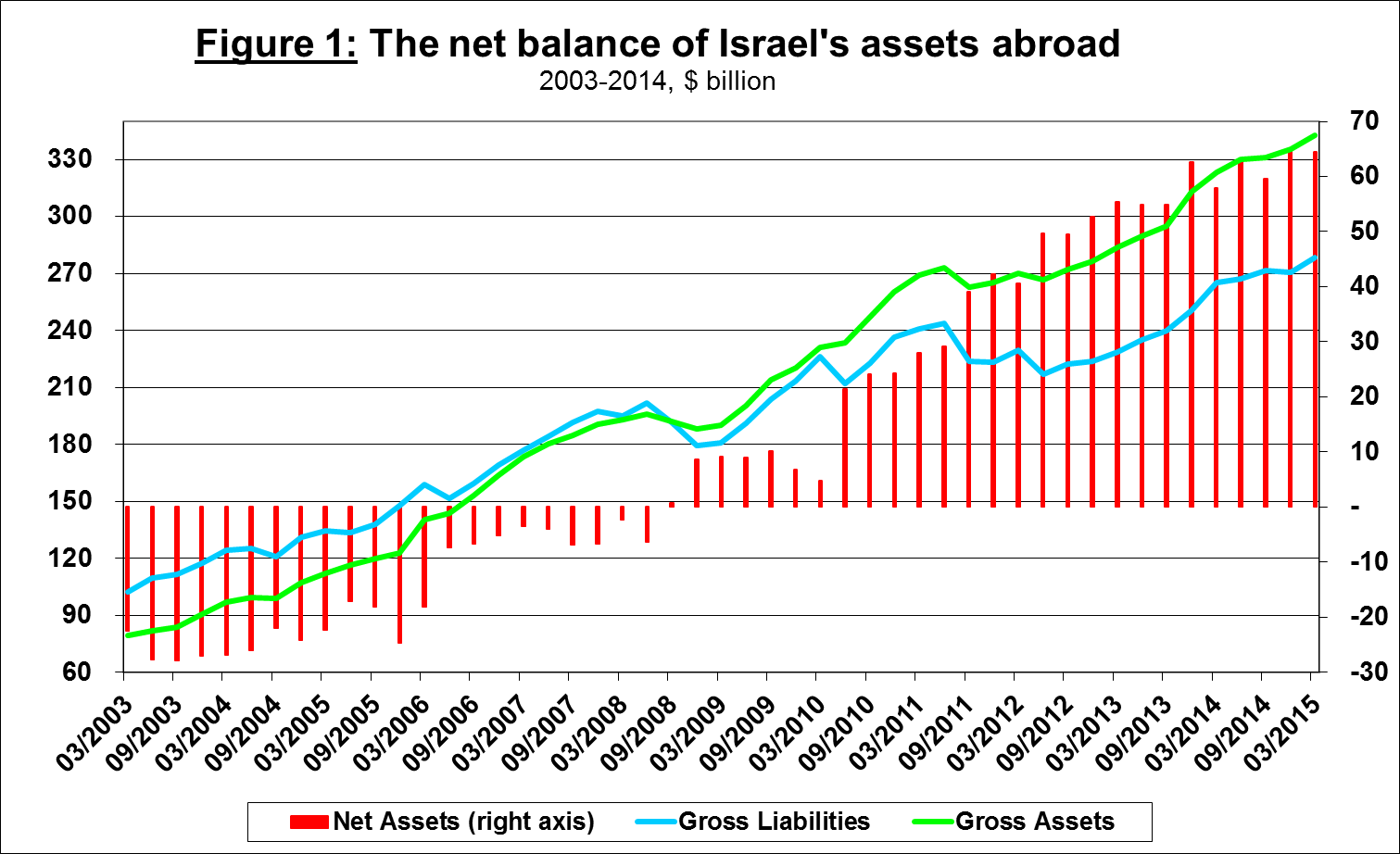

In terms of the composition of residents' securities portfolio abroad, the increase in the share of bank deposits—which began in the second half of 2014—continued in the first quarter of 2015, as did the increase in the share of investments in foreign tradable securities (Figure 2).

The balance of Israel's liabilities to abroad increased during the first quarter of 2015 by about $7.9 billion (2.9 percent), derived from a combination of a marked increase in the prices of Israeli shares held by nonresidents ($5.2 billion, 5.6 percent) and a flow of direct investments totaling $4.2 billion (4.5 percent), which was greater than the average of the preceding four quarters ($2.4 billion).

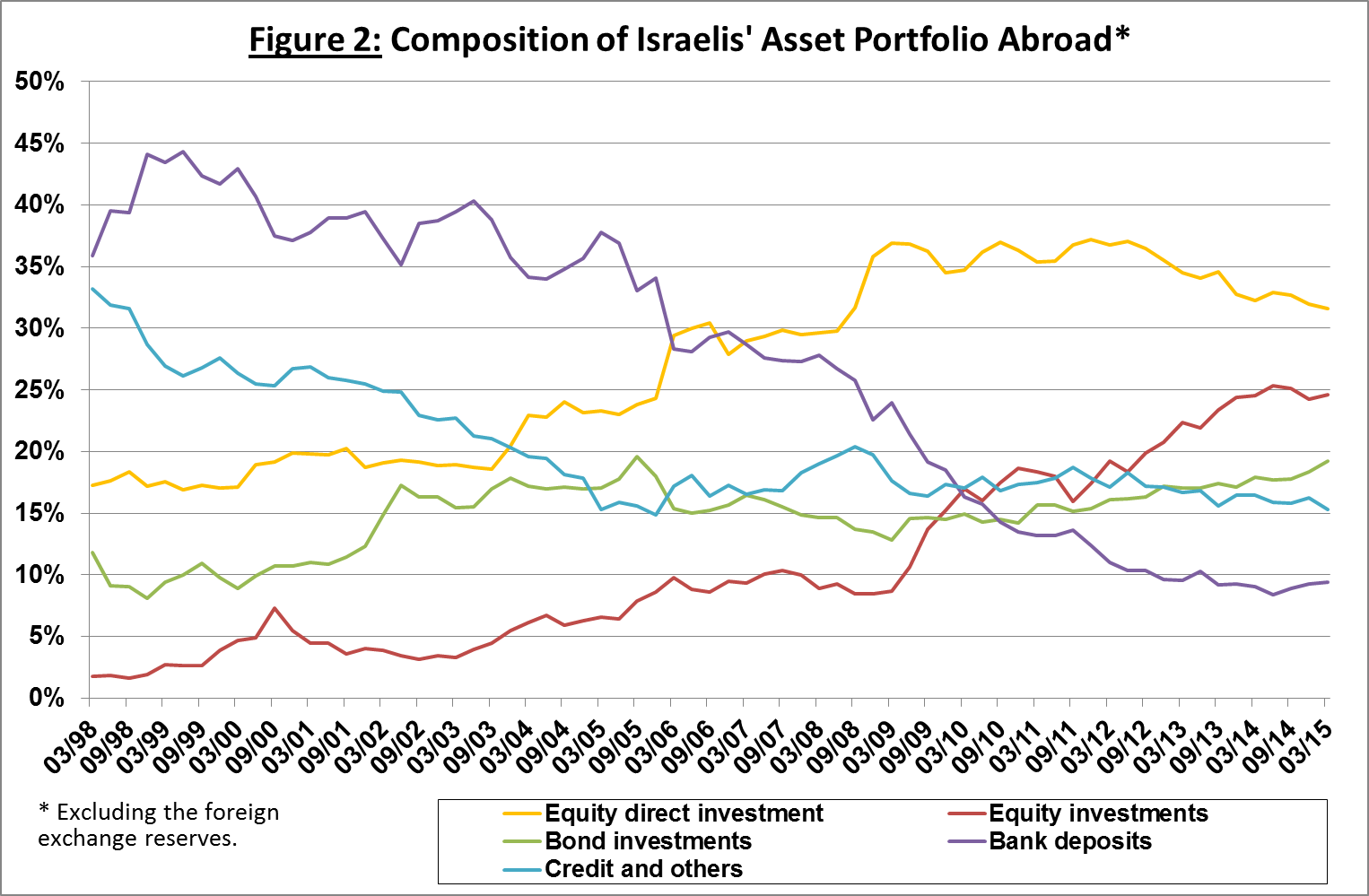

The value of nonresidents' financial portfolio on the Tel Aviv Stock Exchange increased in the first quarter of 2015 by around $2.2 billion (6.5 percent), to about $36.2 billion at the end of March. Nonresidents invested about $1.6 billion in shares and around $0.6 billion in bonds and makam (Figure 3).

The gross external debt

Israel's gross external debt declined by $2.5 billion (2.6 percent) during the first quarter of 2015, reflecting nonresidents’ withdrawals from deposits in Israeli banks, a decline in loans, and realizations by nonresidents of Israeli bonds. The depreciation of the shekel was also a contributing factor to this decline.

The ratio of gross external debt to GDP declined by 0.6 percentage points in the first quarter of 2015, to 33.8 percent at the end of March, in contrast to an increase of 0.9 percentage points in 2014 (Figure 4). The decline derived mainly from a decline in the balance of external debt, which was partially offset by the effect of the shekel’s depreciation on the shekel value of the debt.

The net external debt

The surplus of assets over liabilities abroad in debt instruments alone (negative net external debt) increased by about $5.3 billion (5.3 percent) in the first quarter of 2015, and reached $105 billion at the end of March (Figure 5).

The balance of short-term debt assets was about $137 billion at the end of the first quarter of 2015, mostly in the foreign exchange reserves, reflecting a coverage ratio of 3.5 of short-term debt, an increase compared to the end of 2014.

For the complete data file, click here.