![]() To view this press release as a Word document

To view this press release as a Word document

Borrower risk in the mortgage market: Historical development and assessment under various scenarios.

Between 2008 and 2012 the average price of a home increased by about 54 percent, while average household income increased by only 20 percent. This fact raises several questions about how new buyers financed the sharp increase in home prices—did the loan to value ratio increase? Did the size of mortgages increase—and if so, how did that influence borrowers’ repayment ability?

One of the main indicators of borrowers’ repayment ability is the payment to household income ratio. This indicator is affected by the development of borrowers’ income, the size of the monthly payment which depends on the size of the mortgage, the duration of the mortgage, and the development of interest and inflation rates. Empirical studies from around the world indicate that when a borrower’s payment to income ratio is greater than a specific level, the probability of default increases markedly. Furthermore, research that has studied the link between financial crises and the payment to income ratio have found that a sharp increase in the payment to income ratio serves as a signal of a systemic banking crisis, and the sharper the increase in the payment to income ratio, the deeper the ensuing crisis. Therefore, from macroprudential perspectives, there is considerable importance to monitoring the development of the distribution of borrowers’ payment to income ratios in banks’ housing credit portfolios, and particularly in light of the sharp increase in that balance over the previous 5 years.

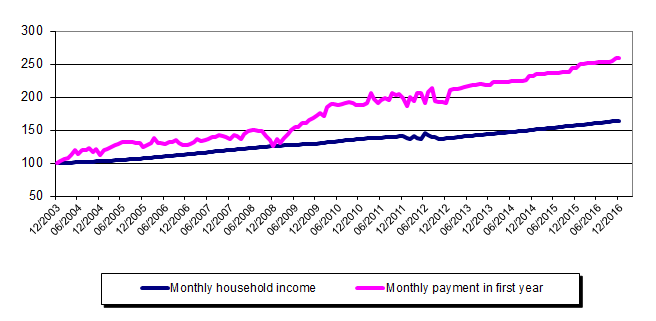

In new research, Dr. Golan Benita and Dr. Ziv Naor from the Bank of Israel Research Department estimate the development—historical and under various scenarios—of the distribution of the payment to income ratios in banks’ housing credit portfolios. Results of the research indicate that due to the sharp increase in mortgage sizes in recent years, the average monthly payment for new mortgage borrowers increased at a higher rate than the increase in average household income (Figure 1). This was despite the sharp decline in interest rates on mortgages in recent years, and new mortgage borrowers taking out loans with longer terms to repayment than in the past. This development led to a marked increase in borrowers’ risk levels in banks’ housing credit portfolios, which was reflected by a sharp increase in both mortgage borrowers’ payment to income ratio, which is currently high compared with other countries (Figure 2), and the share of high risk mortgages (with payment to income ratios above 40 percent). It should be noted that before the increase in home prices, borrower risk in Israel was similar to levels worldwide.

In addition to the historical development of the distribution of the payment to income ratio, the researchers estimate expected developments under several scenarios. Under the first scenario, the researchers assume that home prices will continue to increase in the first year by a similar rate to that of the past two years and afterward will develop in line with the expected inflation rate, average household income will increase in line with its average growth rate in recent years, and inflation and interest rates will develop in line with expectations derived from the capital markets. The study finds that under this scenario, borrowers’ risk in the mortgage market is expected to continue to increase in the coming years. This is due to the continued home price appreciation which will influence the payment to income ratio of new buyers, and the expected increase in the interest rate, which will raise the monthly payments on floating rate mortgages. The share of such mortgages in total mortgage volume increased sharply from 2009–11, reaching a record high rate of about 80 percent right before the Supervisor of Banks imposed a limitation on the share of the floating rate component of a mortgage. As a result, the share of mortgage borrowers’ average monthly repayment in banks’ housing credit balances is very sensitive to changes in the interest rate.

In addition to the scenario of continued home price appreciation, the researchers estimated the development of the payment to income ratio’s distribution under two stress scenarios, which are based on the crisis in the economy during 2002–03: a sharp increase in the interest rate and a recession in real economic activity, which will be reflected by a decline in wage levels and an increase in the unemployment rate. The researchers assume that home prices will react to changes in the interest and unemployment rates with the same elasticity found in previous research. The results of the paper indicate that under both scenarios, borrower risk in the mortgage market is expected to increase sharply and is liable to lead to an increase in default rates. The findings indicate that the effect on borrower risk of a recession in real economic activity is more significant (Figure 3). Furthermore, this scenario potentially contains an even greater risk since—as found in numerous studies worldwide—increased unemployment is one of the main risk factors for defaults, in particular for borrowers with a high payment to income ratio.

Dr. Benita and Dr. Naor emphasize in their paper that as a result of the sharp increase in home prices in recent years, banks’ potential credit loss in the scenario involving defaults declined markedly for mortgages taken out before home prices increased, or in the early stages of the price appreciation. However, it is likely that in a scenario of a sharp increase in defaults with declines in home prices (as expected under the stress scenarios), banks will find it difficult to sell a relatively large number of properties. This development is liable to lead to an additional sharp decline in home prices and to make banks’ credit losses more severe, as occurred in financial crises in other countries.

Supervisor of Banks directives published in August, limiting the payment to income ratio, the term to the repayment, and the share of the floating rate component in mortgages, work to reduce those risks.

Figure 1

Average household income and average monthly payment at the time a mortgage is taken out

(Index, December 2003=100)

Figure 2

International comparison: Average mortgage payment to income ratio, and household debt to GDP ratio (percent)

SOURCE: Payment to income ratio: Worldwide–ECB (2011), Israel–estimate for December 2012 calculated in this paper. Household debt to GDP ratio—OECD data.

Figure 3

Share of mortgages with payment to income ratios above 40 percent in housing credit balance, under stress scenarios