· The Banking Supervision Department is authorized to clarify the public’s complaints in all areas of banking corporations’—banks and credit card companies—activity. This function, which is the responsibility of the Banking Supervision Department’s Public Enquiries Unit, is integrated with other tools used by the Banking Supervision Department to promote fairness and transparency in bank–customer relations.

· In 2014, the Public Enquiries Unit handled 5,555 written enquiries and complaints, of which 4,023 were complaints against a banking corporation’s conduct. The other written enquiries were requests to receive information on consumer rights, questions regarding Banking Supervision policy and various clarifications. In addition, the Department responded to 20,300 telephone enquiries.

· The Banking Supervision Department rates the quality of banks’ dealing with their customers, as reflected in the enquiries and complaints with which it deals. In 2014, Mizrahi-Tefahot received the highest possible rating—“particularly good”, and four banks were given an identical “good” rating by Banking Supervision (Discount, First International, Hapoalim, and Leumi).

· The complaints handled in 2014 dealt primarily with means of payment (19 percent of complaints), current accounts (18 percent of complaints), and housing credit issues (11 percent of complaints).

· Segmentation of the justified complaints by the factor in the failure indicates that the main reasons for them were noncompliance and human error.

· Due to the involvement of the Banking Supervision Department, the banking corporations paid[1] their customers a total of about NIS 3.6 million related to specific complaints, compared to NIS 1.5 million related to specific complaints in the previous year. In addition, a financial sanction of NIS 200,000 was imposed on Discount Bank in respect of not acting in accordance with the Public Enquiries Unit’s determination. Furthermore, due to Banking Supervision Department involvement, approximately NIS 720,000 were returned to customers who are victims of Nazi persecution and who receive allowances or pensions, in respect of fees charged to them in contrast to the fee schedule set by the bank for such activity.

· In April 2015, a Proper Conduct of Banking Business directive dealing with the handling of public enquiries came into force, in accordance with principles set by the OECD for protecting financial service consumers. The directive requires banking corporation to deal with their customers’ complaints effectively, by regulating the status, responsibility, and function of public enquiries representatives (Ombudsmen) in banking corporations and the systems subject to them. The goal of the directive is to ensure banking corporations’ fair and effective handling of their customers’ complaints, and to maintain a high level of fairness in bank–customer relations. The background to the directive is experience showing that most complaints can be resolved more effectively through an internal ombudsman and the interest in the Banking Supervision Department’s Public Enquiries Unit emphasizing the handling of material complaints that impact on a large number of customers. The directive establishes that a banking corporation is to deal with a customer’s complaint within 45 days at most. If customers feel that their complaints were not handled appropriately or that the banking corporation did not respond within the time limit, they may request that the Banking Supervision Department’s Public Enquiries Unit examine the matter.

Number of enquiries and complaints for which handling was completed, and number of justified complaints, 2014 compared with 2013

2013 |

2014 | |

Number of enquiries received by telephone |

21,450 |

20,346 |

Number of enquiries and complaints received in writing

of which: |

5,067 |

5,555 |

Number of complaints |

1,549 |

4,022 |

Number of complaints on which a position was taken |

1,131 |

1,602 |

Number of complaints found justified |

251 |

253 |

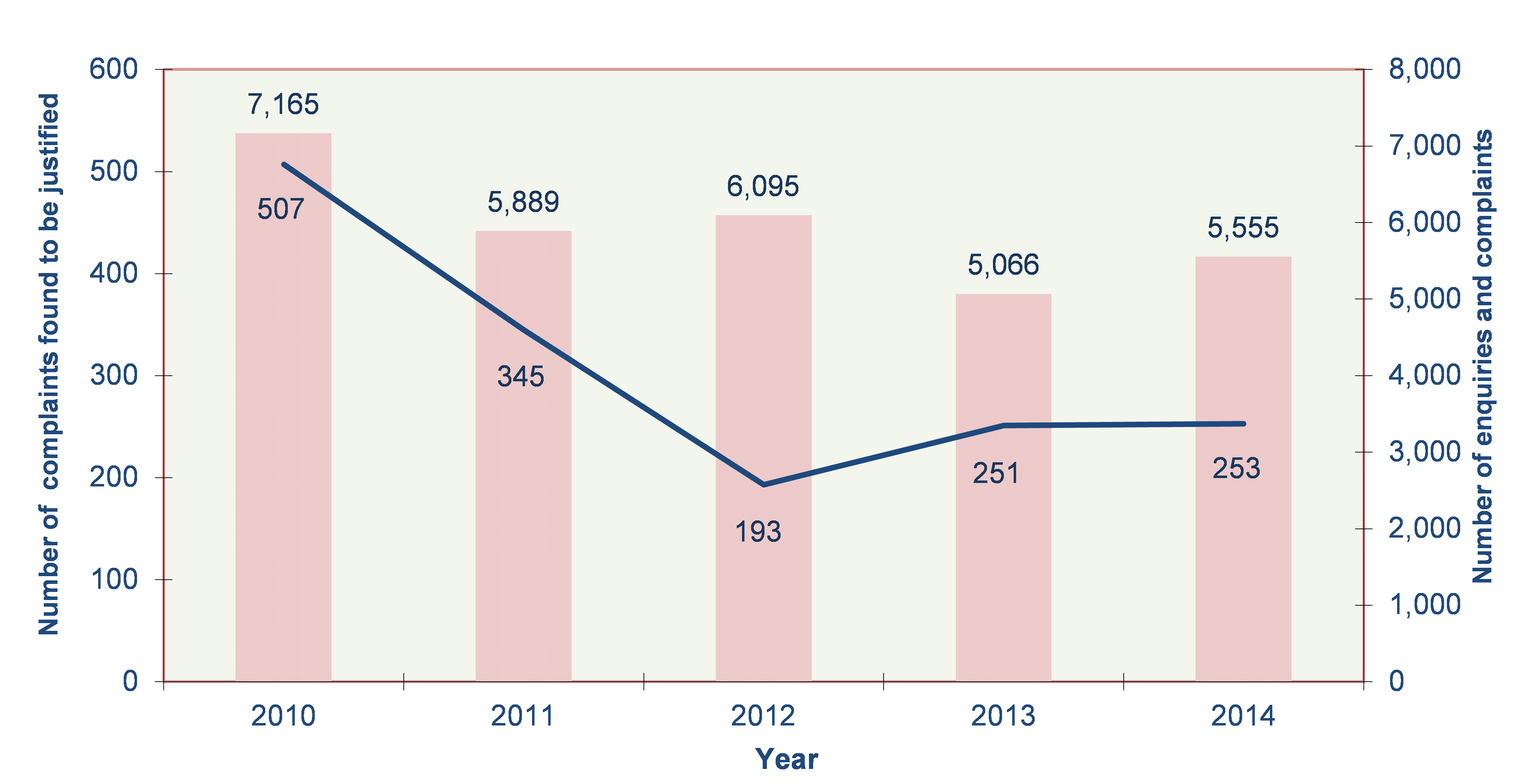

Proportion of complaints and enquiries submitted in writing, and number of complaints found to be justified, 2010–14

The overall ratings of the five largest banks

The rating is based on a weighted score of the four criteria detailed in the complete report.[2]

Bank[1] |

2012 Rating |

2013 Rating |

2014 Rating |

Mizrahi-Tefahot |

Adequate |

Good |

Particularly Good |

Discount |

Adequate |

Good |

Good |

First International |

Good |

Good |

Good |

Hapoalim |

Adequate |

Adequate |

Good |

Leumi |

Good |

Good |

Good |

[1] The order of appearance of the banks in the table is by their 2014 rating, and within the rating by Hebrew alphabetical order.

The Public Enquiries Unit of the Banking Supervision Department continues to serve the public in all aspects of its relations with the banks and credit card companies. For information on how to submit bank-related complaints, contact the Public Enquiries Unit:

· Fax: 02-666-9077

· Tel: 02-655-2680

· Address: PO Box 780 Jerusalem 91007

[1] Including debt writeoffs.

[2] The rating of the banking corporations was based only on data received by the Banking Supervision Department following the handling of customer enquiries and complaints, and is provided as a service to the public. This rating does not provide an overall grade for a banking corporation regarding its range of activities, and thus must not be seen as any suggestion or recommendation.

[3] The order of appearance of the banks in the table is by their 2014 rating, and within the rating by Hebrew alphabetical order.